cryptocurrency investment strategies for beginners

If you are new to the world of cryptocurrency, it can be a little bit of a whirlwind and there can be many temptations to jump in headfirst. With that said, below are some ideas for beginners that can help you cut down your risk and hopefully allow for maximized return.

1:At the Beginning: Start researching.

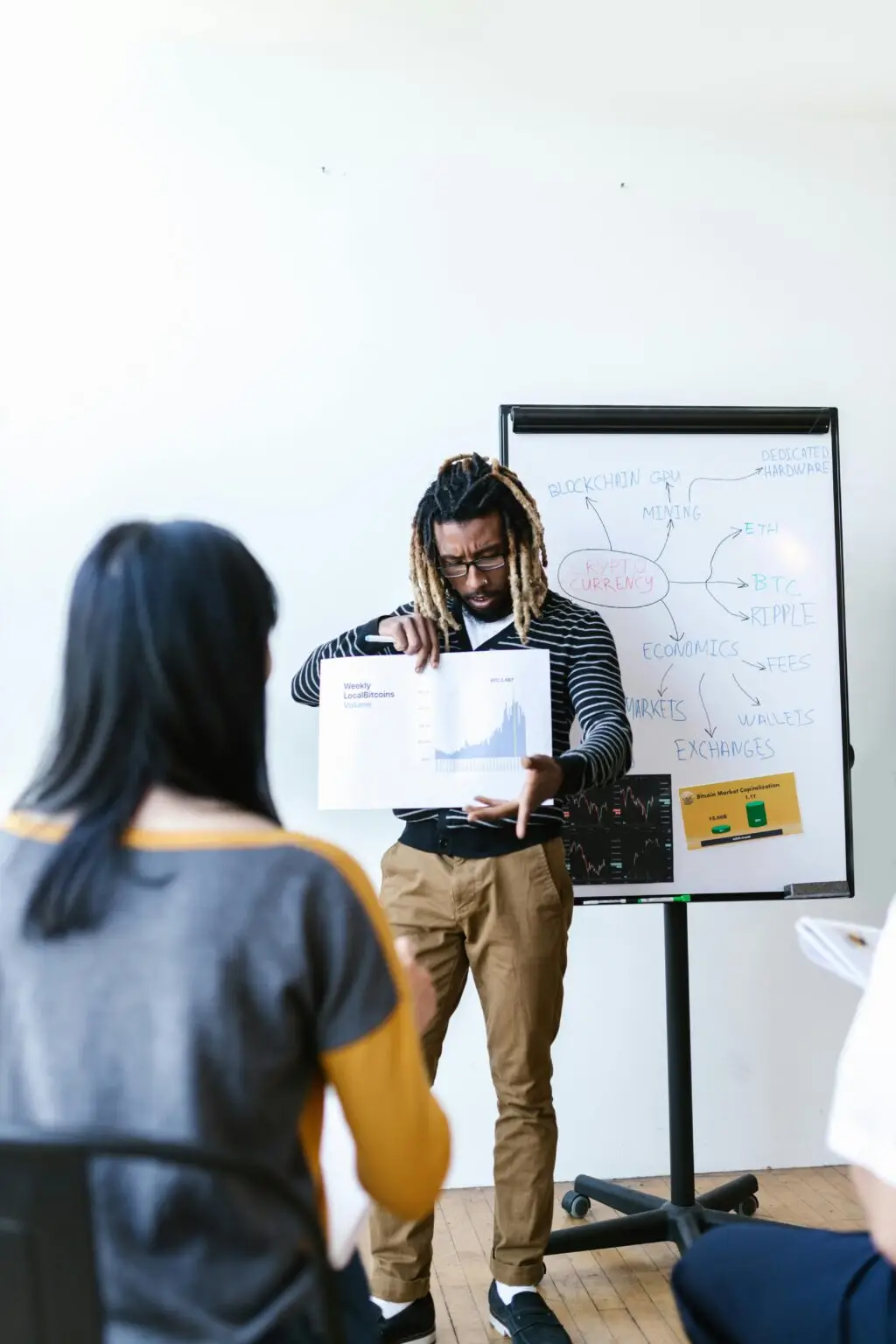

Get to know the market: Learn the basics of how cryptocurrency works. Find out how blockchain technology, mining, wallets, and exchanges work and their roles in the crypto ecosystem.

Top Cryptos: Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT are probably the most recognizable. They will typically be stable because they are compared to the market compared to smaller more obscure coins.

White papers: Every crypto project—for the most part—comes with a white paper, which is basically a document outlining the goal of the project and how the coin works. White papers are worth a glance (for due diligence) prior to putting your money into the project.

2:Dollar-cost averaging (DCA).

What is it? Dollar-cost averaging is a mechanical way to say a fixed amount of money in cryptocurrency at a predetermined time interval (like weekly, monthly) no matter what the price of the coin is. With this strategy, the effect of volatility is lowered due to the multiple intervals and you’ll never have to guess at the timing of the market.

Why it’s good for beginners: DCA is a low-easy approach that takes out the stress of investing if you’re new and it takes the guesswork out of predicting the price movements over short periods of time.Example: You are investing $100 every week into Bitcoin. Some weeks you are buys when the price is up, and some week you are buying when the price low, and you are averaging out the price over a period of time.

3:Diversification

Don’t keep all your money in one place: Even though Bitcoin and Ethereum cryptocurrency are typically considered the safer bets, and there are thousands of other altcoins, these altcoins can be far more volatile (read: fluctuating price).

Spread your risk through diversification: You might invest in different types of cryptocurrencies: large cap, mid cap, and small cap. A typical beginner portfolio might look like:

50% in Bitcoin (BTC) or Ethereum (ETH)

30% in other mid tier altcoins,

20% in stablecoins (USDC or USDT) which are less volatile, that can be used to hedge when / if the crypto markets swing down.

4:Use a Wallet

Hot Wallet vs. Cold Wallet:

A hot wallet (exchange, or downloading mobile wallet) can make accessing your crypto a lot easier, however can be hacked, being connected to the internet.

Cold wallets (hardware wallets like Ledger, or Trezor) will be offline and therefore will be much safer.

Storing your crypto: It is best to move your holdings to a cold wallet if you are investing long-term. Crypto on exchanges can still be hacked.Create a Budget and Stick to the Budget

Invest Only What You Can Afford to Lose: Because cryptocurrency can be very volatile, you should never invest money that you can’t afford to lose. Start small, especially if you are a beginner.

Use Limit Orders & Stop Losses: If you are a little more active in trading and you want to mitigate your losses, you can setup limit orders and stop-loss orders to automatically sell if the price of a coin goes below your threshold.

5:Long Term Holding (HODL)

What is HODL? HODL originated from a typo of the word “hold” when someone was upset that they had lost money in the Bitcoin market crash back in 2013, that it has morphed into a long term investment strategy – to HODL – meaning to buy your crypto and hold it for multi-year time horizons despite the price variation of the day.

Why it’s great for beginners: You don’t have to stare at the price continuously and buy and sell like a trader, and historically, long term holding has provided favorable results for the major cryptocurrencies like Bitcoin.Don’t Fall Victim to FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt) Keep The Focus: An emotional reaction (FOMO or FUD) in the cryptocurrency market is easy to have by social media, influencers, or reporting in the media. People panic sell in market crashes or get over-excited buying coins in a bull market. It’s important to stick to your strategy especially if you researched and created one and don’t let the emotion of the market compel you into making bad short-term decisions.

FOMO – Don’t chase hype coins unless you have done your due diligence

FUD – Just remember, if you see so much negative news, don’t panic. Take a moment to assess the situation before responding.

6:Stay Informed with Market Trends

Trusted News Sources – Follow trusted cryptocurrency news channels (such as, CoinDesk, CoinTelegraph, or The Block) and stay informed(metrics and facts on coins are a good avenue for establishing validity of your strategies).

Learn More About Staking and yield farming

Staking – Some cryptocurrencies, like Ethereum 2.0, allow you to stake your coins in exchange for interest. Alternatively, staking could also be a way for passive income, just be sure to check the risks before staking your coins.

Yield Farming – In DeFi (Decentralized Finance), being able to earn interest on your crypto, you can also provide liquidity for different platforms; there are differences in complexity and risk involved, but it is worth considering as you gain experience.Participate in Communities: Look to Reddit, Twitter, and crypto-specific forms (Bitcointalk) for learning from experienced investors. Just remember to always be wary of unverified info.

7:Think About Taxes & Legal Regulations

Tax Considerations: In the majority of countries, profits from cryptocurrency investments are taxable. Follow the rules and know how taxes will apply to your activities and earnings. Keep records of all transactions you have done (buys, sells, transfer, etc.).

The Regulatory Side of Things: Certain countries have strict rules over cryptocurrency, so always check your local laws & regulations to avoid future headaches!

8:Use Secure Exchanges

The Best Beginners Choices: For cryptocurrency, exchanges like Coinbase, Binance, Kraken, and Gemini will all be suitable for people new to investing in cryptocurrencies. All of these exchanges offer user-friendly interfaces and security features; you just always have to practice good security practices (opting in for two-factor authentication (2FA), etc.).